What’s the Difference Between the Equifax and FICO Scores? Learn More

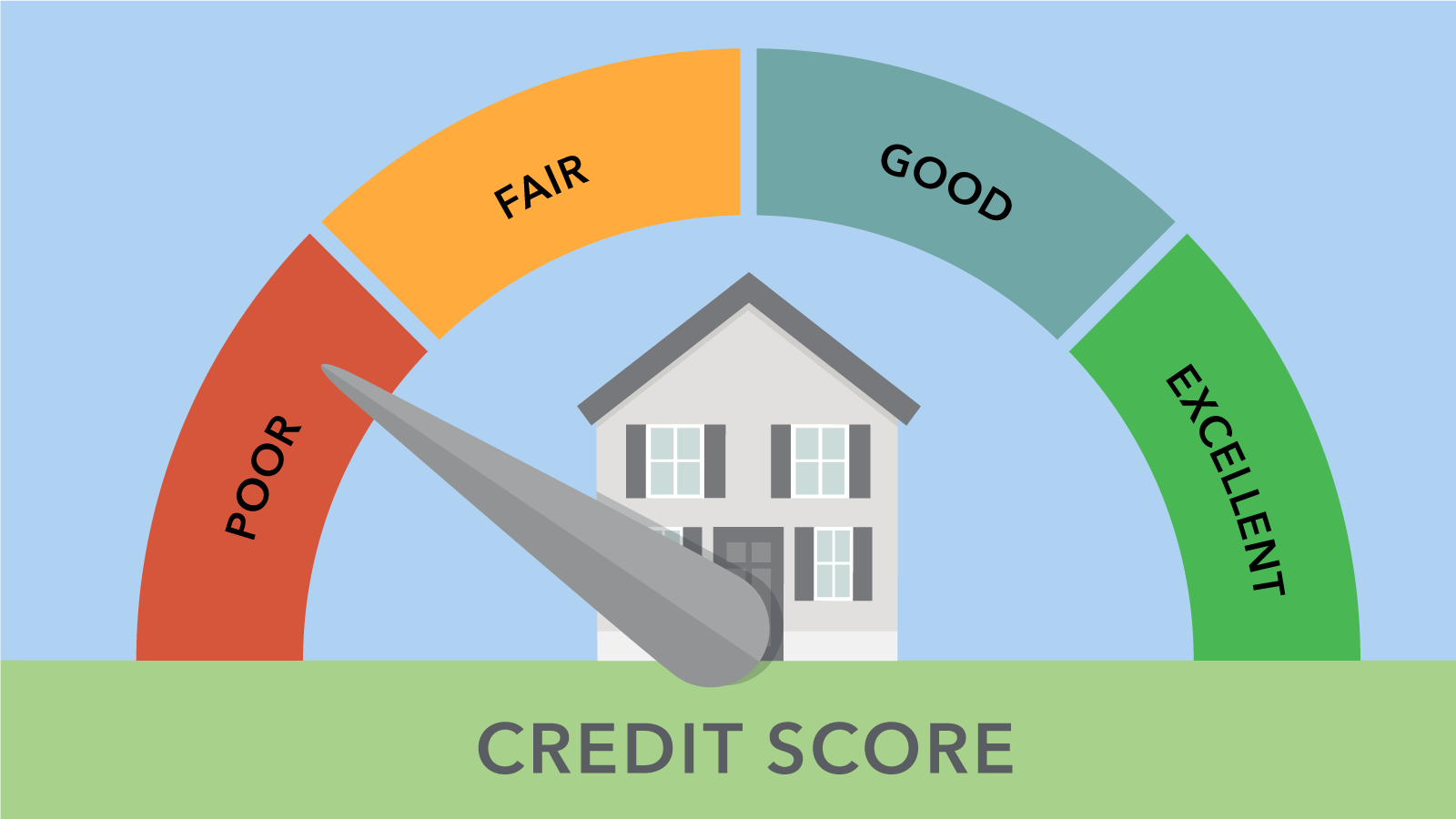

Your credit score plays the most important role in determining whether your loan application will be accepted by the lender or not. If you already fulfill the eligibility criteria for a loan, then it is your credit score that can make or break your application. In this article, we will take a look at the … Read more