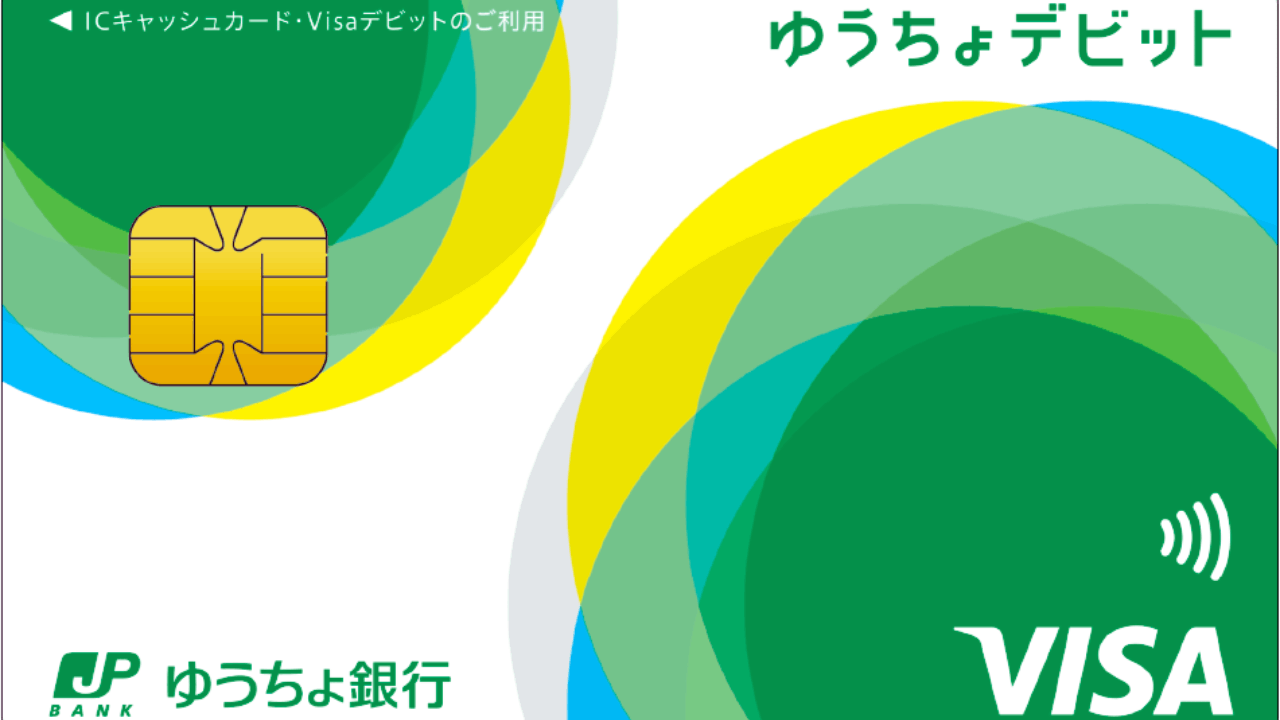

When you use your credit card in Japan, you might have to pay more due to the foreign transaction fee. Many people often do not want to pay for such a fee every time they use their credit card for any transaction. This is why the Japan Post Visa Credit Card is the best credit card to use in the country.

The Japan Post Visa Credit Card is one of the easiest credit cards you can apply for if you’re either a foreigner or a local in Japan. It offers some of the best features, and you can get as much value from the card when you use it in partner establishments.

Check out the article below to learn more about the Japan Post Visa Credit Card and how you can apply for it.

Get to Know the Japan Post Visa Credit Card More

There are a lot of things to discover about the Japan Post Visa Credit Card.

It is commonly used in Japan due to its popularity and its myriad of partner establishments where you can use a credit card.

Here are some of the features and benefits that you can enjoy when you have this credit card.

Rewards Program

The Japan Post Visa Credit Card has a very robust rewards program where you can earn reward points for every transaction that you make.

For every 1,000 yen that you spend, you get 1 reward point. You can use the card at partner establishments, pay for your meals and groceries, and make any other transactions.

You can then redeem the reward points for miles, which you can use for discounts and save money for traveling.

Redeeming Your Rewards

To redeem your rewards, simply head over to the official website and log in to your account. Enter your 10-digit ANA Mileage Club membership number to gain access to your account.

On the website, you can choose from a wide variety of options on how to redeem your miles for discounts on flights and other bookings.

It will take about a week for the rewards to be fully converted, and it will appear on your account.

What is the Interest Rate?

When it comes to interest rates, the Japan Post Visa Credit Card has one of the most affordable interest rates.

The purchase rate is usually around 15% to 20%, but it will still depend on your creditworthiness based on your credit score.

Your credit limit will also be determined during your application.

Contact Details You Need to Know

You can find the main office of the Japan Post Visa Credit Card at 2-3-1 Otemachi, Chiyoda-ku, Tokyo 100-8793.

You may also call their customer service hotline at 03-6627-4045 in Tokyo or 06-6445-3206 in Osaka.

What to Prepare Before Applying for the Japan Post Visa Credit Card

There are a lot of things that you need to prepare before you can apply for the Japan Post Visa Credit Card.

First, you need to find out if you are eligible for the card. Whether you’re a foreigner living in Japan or a local, you still need to be eligible to apply.

Applicants must be 18 years old and above, must have a good income, and have the proper documents for verification. These documents include your proof of income and your residency status.

The first step of applying for a credit card is gathering all of these documents and preparing them before you apply.

Applying for the Japan Post Visa Credit Card

Once you have prepared all of the requirements, you can then choose to apply online or in person. You can directly apply at the official website, which is faster and more convenient.

Navigate to the credit card section and fill out the application form with your details. Upload the necessary documents and make sure that you check the spelling and the files that you have uploaded.

Review the terms and conditions, and if you’re ready, submit the application form and await their approval.

Tips for Applying for the Japan Post Visa Credit Card

While the entire application procedure for the Japan Post Visa Credit Card has been simplified, you should still learn a few things about applying to increase your chances of getting approved.

Here are some tips to apply when you opt for the Japan Post Visa Credit Card. A bank representative will be able to provide you with assistance regarding your inquiry.

You can also contact their hotline if you want to receive updates on your application.

Double-Check the Eligibility Requirements

Always make sure that you are eligible for the card before you apply for it.

You save a lot of time and money by checking the eligibility requirements. If you don’t qualify, you can explore other credit card options.

It pays to be detail-oriented when you apply for credit cards like this.

Prepare the Documents Before Applying

Other requirements that you need to submit when applying for a credit card are the documents.

Make sure that you have both physical and digital copies of the required documents even before you apply for the card.

Having the required documents makes the entire application process much faster, and if you provide them with the complete documents, you stand a better chance of getting approved.

Enter Your Information Accurately

When you enter your information on the application form, you need to make sure that you enter it as accurately as possible.

There is no room for you to make spelling errors. If you have to apply directly at the bank, make sure that you write legibly so they can properly check the details.

A lot of delays happen due to misspelled words or inaccurate information found on the application form.

Conclusion

Knowing how difficult it can be to apply for a credit card in Japan, both locals and foreigners can rest easy knowing that the Japan Post Visa Credit Card makes it a lot easier to apply for a credit card.

All you need to do is follow the application steps and make sure that you accurately provide the information. Best of luck with your application process.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.