Credit Budgeting Tips – Learn How Budgeting Can Improve Credit

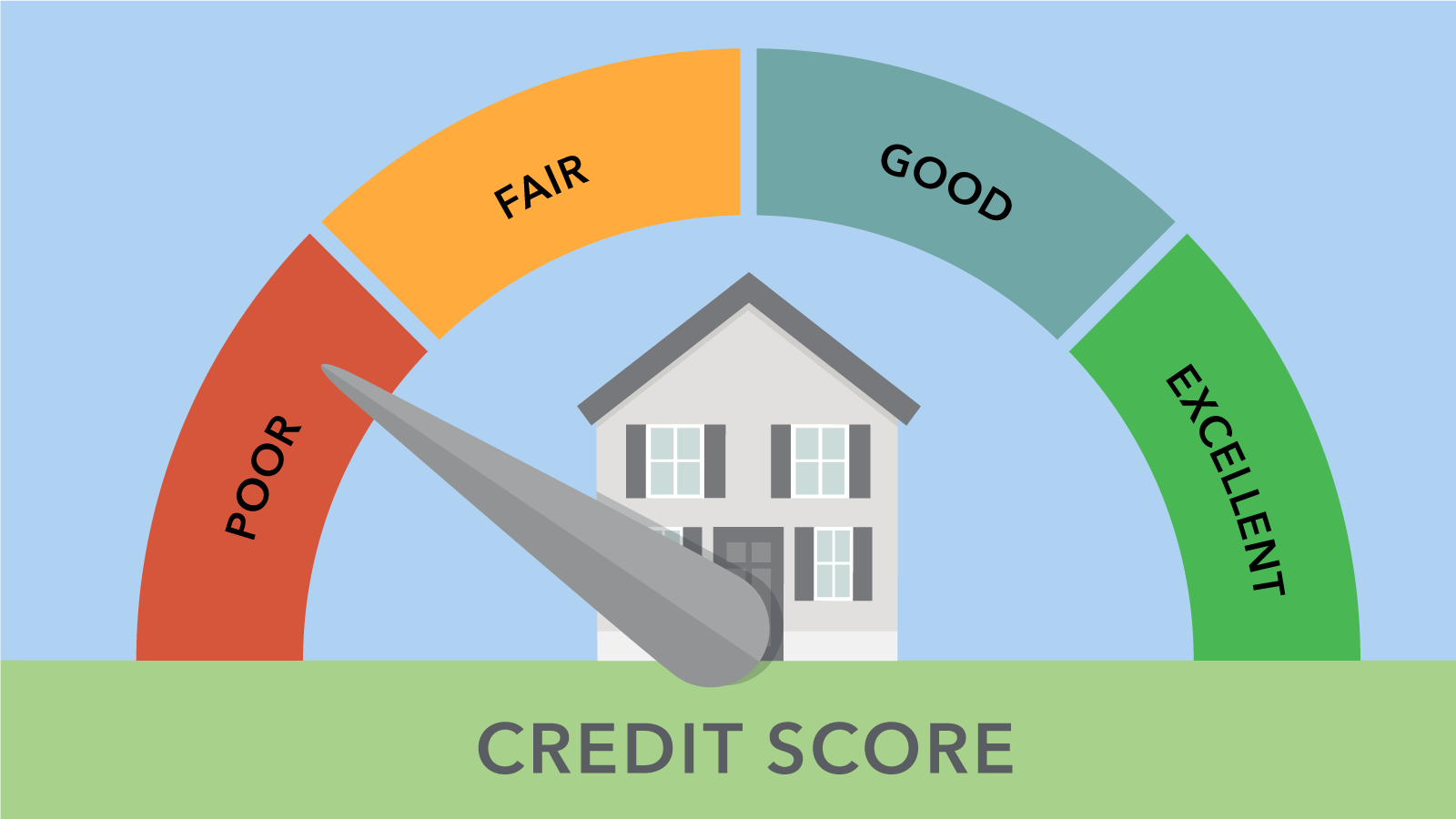

Bad credit ruins your credit history and will affect your financial future. Before any financial institution extends to you a credit product such as an auto loan, student loan, mortgage, or credit card, they first look at your credit history. Therefore, you want to pay your debts on time and maintain a good credit history. … Read more