Banking without going to the bank is what makes our lives much simpler these days. Online banking has changed the way we deal with our finances, especially with how we manage and use our credit cards. More and more banks allow us to deposit checks, make online transactions, and even apply for credit cards on their website or mobile app.

You can even access your banking information on your computer or mobile device or wherever you can access the internet. There are a lot of banks nowadays that offer online banking as a way to continue supporting their clients and extend their services beyond banking hours safely and securely.

With that in mind, check the article below to discover ways that online banking has changed credit card usage in today’s modern world.

Advantages of Digital Banking in Using Credit Cards

One of the major advantages of digital banking is the convenience that it has provided especially for credit card users.

Not only are you able to pay for items that you want to purchase online, but you can also do other transactions such as paying for your utility bills and even making transfers without having to go to the bank. It can be easily done at any time of the day.

It is fast and very efficient with the transactions so you don’t have to go to the establishment, run your card, and complete the transaction.

Credit cards are widely used today and if you want to have seamless transactions without worrying about security, online banking using credit cards is the way to go.

Challenges with Online Banking

While there are several advantages to online banking and the use of credit cards, there are also challenges that come with it. There is a steep learning curve for anyone new to online banking, especially with using credit cards.

This prevents transactions from happening as they need more time to understand the online procedures. This is one of the reasons why many people still want to do personal transactions by going to the bank or to the establishment that they want to purchase from. Additionally, online banking is heavily reliant on your internet connection.

If there are issues with your connection, your transactions might suffer as well and you might end up having to deal with tons of issues with the transactions.

Easy Account Management

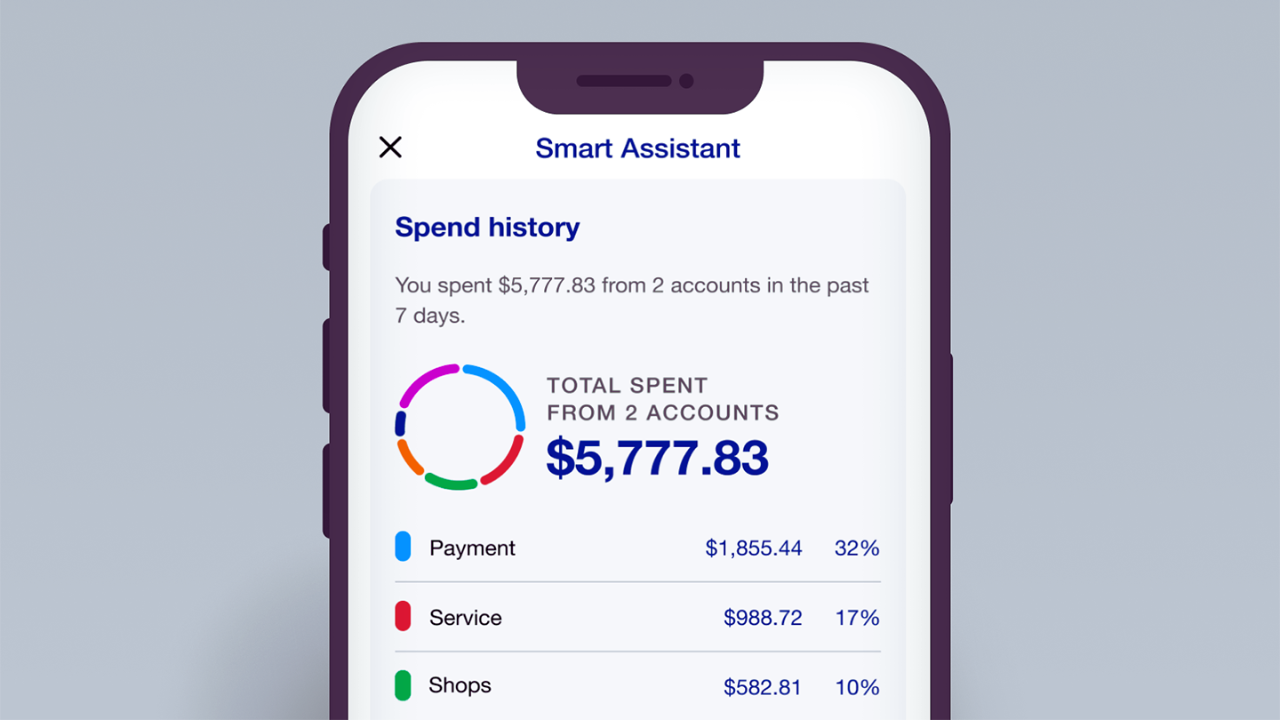

Online banking has truly changed the way we use our credit cards nowadays. In the past, the only way for us to manage our credit account is by checking it at the bank or making a call through customer support.

This can be a real hassle if you need to check your account to manage certain transactions. With mobile apps and digital banking on the rise, all you need to do is to download the mobile banking app, link your credit card account, and you can easily manage it right in the comfort of your home.

Everything that you need is within a single app. You can make transfers between your account, request a specific bank document or even do transactions with your credit card with just one single mobile app. Online banking has made this possible.

Increased Accessibility

In connection with the point above, online banking has also made it fairly easy to access your account. Whether you’re at home or the office or even on the road, you can easily check your account on your mobile device as long as you have an internet or mobile data connection.

Online banking and using your credit card can now be done in just a few taps on the screen and you don’t even need to use your physical credit card to complete the entire transaction. You can easily check if the transaction is valid or you can view all the other entries if you want to check previous transactions.

Better Security Features

With increased accessibility comes an increased risk of exposure, this is the reason why online banking is quite apprehensive for certain people who value security and privacy.

Many banks have also tightened their security features on online banking transactions and credit card usage. Mobile apps nowadays have better security features than before. Before, all you need to do was to present your card to complete the transaction but this also comes with a risk of duplicating your credit card information to be used somewhere else.

This has happened a lot in the past but with online banking, things have certainly changed. There are now security features that protect your account from being duped and from many other threats thus lessening the chances of you getting victimized.

You can even easily deactivate or reactivate your card from the app if you find something suspicious with your account.

Get Complete Control Over Your Account

With online banking, you get complete control over your finances with the self-service features of these mobile apps. Unlike when you’re banking in person, these mobile apps that also let you link your credit card have no restrictions.

You can’t perform any banking transactions when the bank closes but if you have the mobile app to do online banking, you can easily use the card for transactions.

Many banks continue to improve the features on their mobile banking platforms and provide more control to their customers nowadays with notifications for low balances or even payment prompts. You can even activate your new credit card by just using the app.

Conclusion

Credit card usage has changed in the past few years with the help of online banking. With its fast, inexpensive, and convenient methods, online banking has made our everyday financial transactions and credit card usage easier to handle.

If you have a bank, you likely also have to download a mobile banking app. All you need to do is download the app and register an account then link your credit cards to the account to start using the online banking features to your advantage. With the advances in technology, handling your finances and credit cards is now easier with online banking!